News

A look at absa personal loan online IZwe Money

14 December 2021

If you’re looking for personal fund which might be more straightforward to qualify to own while having lower rates of interest than their bank also offers, next IZwe Loans could well be advisable to you. With over a decade of expertise in the lead financial business, we provide unsecured loans that have several choices designed to satisfy your individual requires. Which have signature loans anybody can possess a customized rate of interest and you can amount borrowed hence suits debt requirements. Whether need a little personal bank loan as high as R50k – or more, you can expect a good customised loan option having versatile loan terms of around 60 weeks and you will a straightforward on line software! For more information throughout the IZwe personal loans, click the links less than.

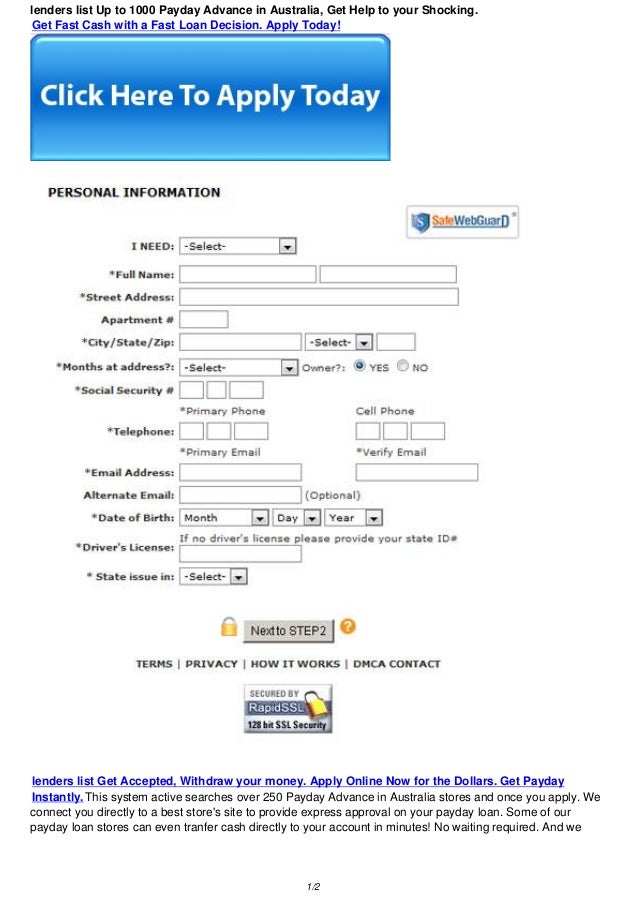

To help you submit an application for IZwe personal loans you are going to earliest have to availability the secure money page. You’re required your mastercard information and password. After you’ve done this you’ll be able to to make use of to possess an effective customised unsecured loan matter having fun with a cards/debit cards. Here is the fastest way of getting the cash you desire – however you will never be billed any charges for borrowing.

absa personal loan online Just in case you require a bigger amount of financing IZwe individual finance will let you plan a fixed label. This means you could potentially favor an interest rate over the full identity of the financing and need to pay this straight back across the decided label. This also implies that your monthly money was below should you have chose to obtain yet another personal bank loan. At the same time, the newest cost several months is commonly longer after you strategy a fixed identity loan as it requires extended to go back the capital than simply it can to only choose a shorter name. At exactly the same time, of several loan providers supply interest bonuses toward number you’re capable use.

The expense of IZwe unsecured loans are very different according to the personal issues of one’s borrower. You can find different types of unsecured loans that are offered. Such as, you will find IZwe mortgage and link fund being a whole lot more akin in order to mortgage loans than just IZwe funds. These could also be removed over years as well as gives far better balances with regards to the monthly money. When taking aside such as for instance a home loan or connection mortgage you might arrange the lowest and variable interest solution.

An alternative IZwe personal loans is referred to as a great pay day loan. Speaking of much like the more prevalent type of small title money, constantly available with banks or any other reputable financing associations. Money are available within a few days so you’re able to each week, with most individuals repaying the mortgage of the deadline. New costs might be small, but some lenders ensure it is extra self-reliance on money. They truly are paid more longer terms and conditions, delivering a lot more coverage to your debtor. One thing to consider when considering an instant payday loan is the fact the attention was extra about the concept count therefore it is essential to make sure you know exactly what you should be paying.

There are also IZwe pay-day signature loans offering a flexible repayment package. This new repayment months is founded on just how much you’ve got lent. In the event the funds is difficult to sort out at times which is obviously an attractive option to envision. You might stretch the fresh cost months if you learn you are incapable of maintain the money. In this case the eye fees will add up immediately.

When shopping for the best selling on the IZwe unsecured loans it is better to talk to a brokerage towards certain alternatives readily available. An excellent agent offers a great amount of advice according to the interest cost and you may installment options, helping you to result in the best bet. not, it is vital to bear in mind that the fresh new fees often will vary ranging from loan providers in addition to conditions and terms will be different if you go for a top payment term or down charge.

One thing that is great is the fact that interest rates to your these types of unsecured loans are usually reasonable than the other finance. The one key to and make an endurance of the repayments is to simply use what you need, because you will shell out significantly more desire across the months for those who extend new money. Like that you’ll remember to constantly manage to continue with repayments and you will certainly be pleased you have the safety away from a loan for anyone who is facing emergency.